A Gender Lens on Pakistan's Startup Investment Landscape

Note: In the following analysis;

Female-founded startups refer to Female-only teams (1 or more female founders)

Female co-founded startups refer to Mixed-gender teams (at least 1 female founder)

Pakistan's startup ecosystem has rapidly developed in the past few years. Although currently experiencing an economic slowdown, the ecosystem’s stakeholders continue to demonstrate resilience and a forward-thinking approach.

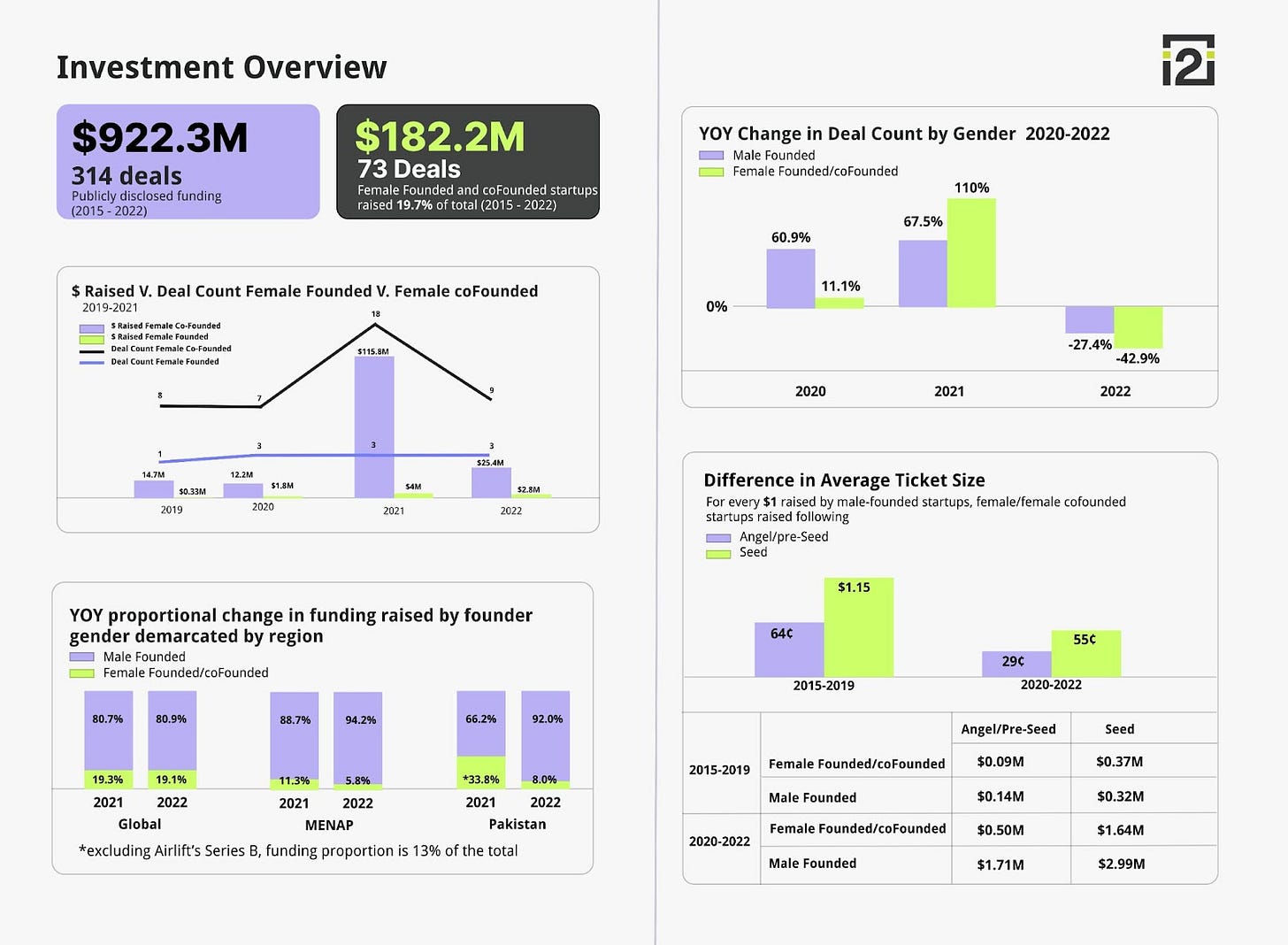

The funding boom of 2021 had a notable impact on narrowing the gender funding gap for female-founded and co-founded companies, as they were able to secure an impressive 34% of the total startup funding. This development marked a positive step towards addressing the persistent gender funding gap that the global and regional startup ecosystem has been struggling to overcome. However, the funding slowdown experienced in 2022 had a disproportionate impact on female-founded and co-founded companies. They raised only 8% of the total startup funding in Pakistan, and secured under 6% in the MENAP region. Globally, no significant change was observed, but the total funding amounted to only 19% of the total.

Witnessing this imbalance, we were curious to explore who bears the brunt during tough times. Thus, to gain a better understanding of the experiences of female founders in Pakistan’s ecosystem, we examined the investment landscape through a gender lens.

During the period between 2015 to 2022, female-founded and co-founded startups managed to raise approximately 20% of the total publicly disclosed funding. However, this percentage fluctuated considerably each year.

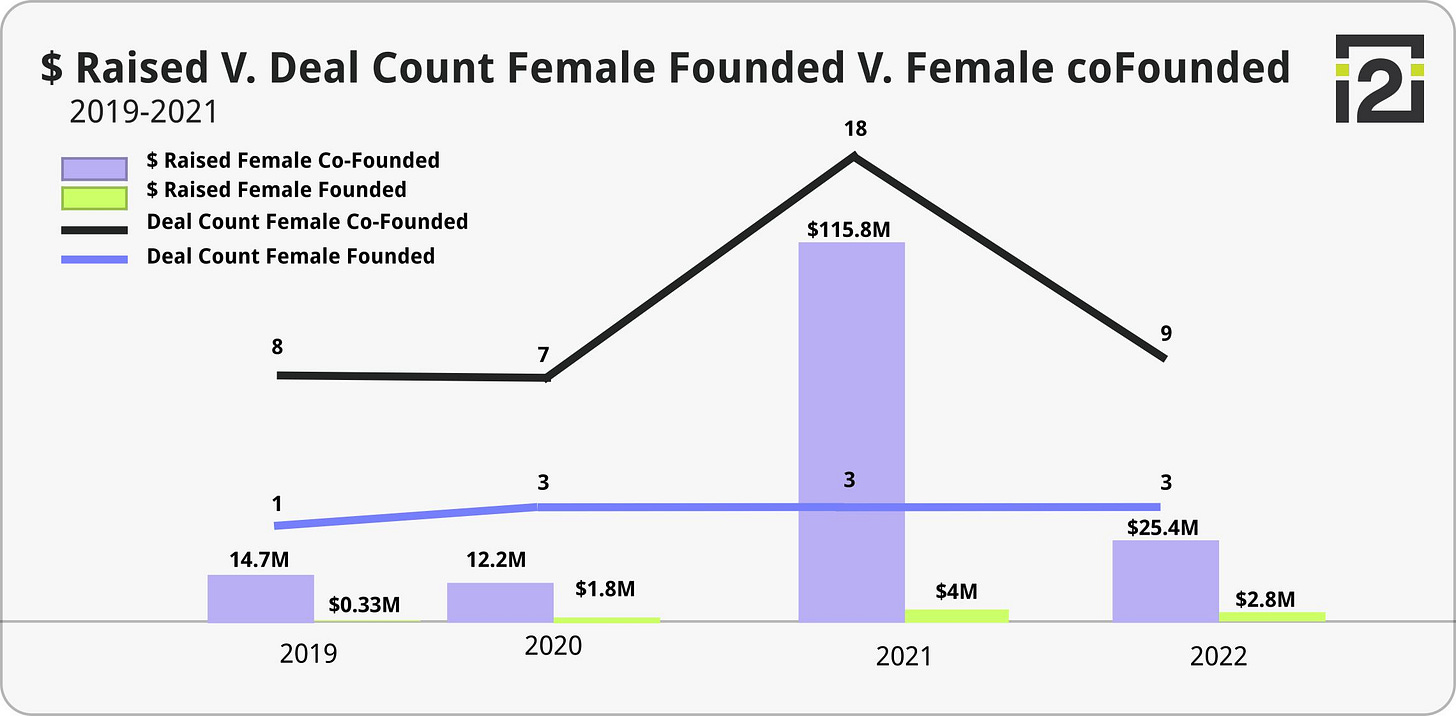

A breakdown of the total deals closed by female-founded and co-founded startups in recent years reveals that female-founded startups closed a static 3 deals per year, even when startup funding poured into the ecosystem in 2021. Prior to 2020, female-founded startups averaged just 2.5 deals per year, indicating little improvement in recent years.

In contrast, the growing confidence in the ecosystem translated into a higher number of deals closed by female co-founded startups, which jumped from 7 to 18 publicly disclosed deals from 2020 to 2021.

These numbers point to the inherent biases that the ecosystem must address beyond pipeline challenges for female-founded startups. Specifically, there is a need to be mindful of how important it is considered by the investor community to have a male founder at the table when a startup raises funds, and how it disproportionately impacts female-only founding teams. Are female-founded and co-founded startups perceived as significantly riskier when things become tough? This perception bias may explain the low number of deals closed by female-founded and co-founded startups in 2022, which saw a 43% drop compared to a 27% decrease in total deals closed by male founders. Clearly, when uncertainty seeped into the ecosystem, female co-founded companies suffered the most.

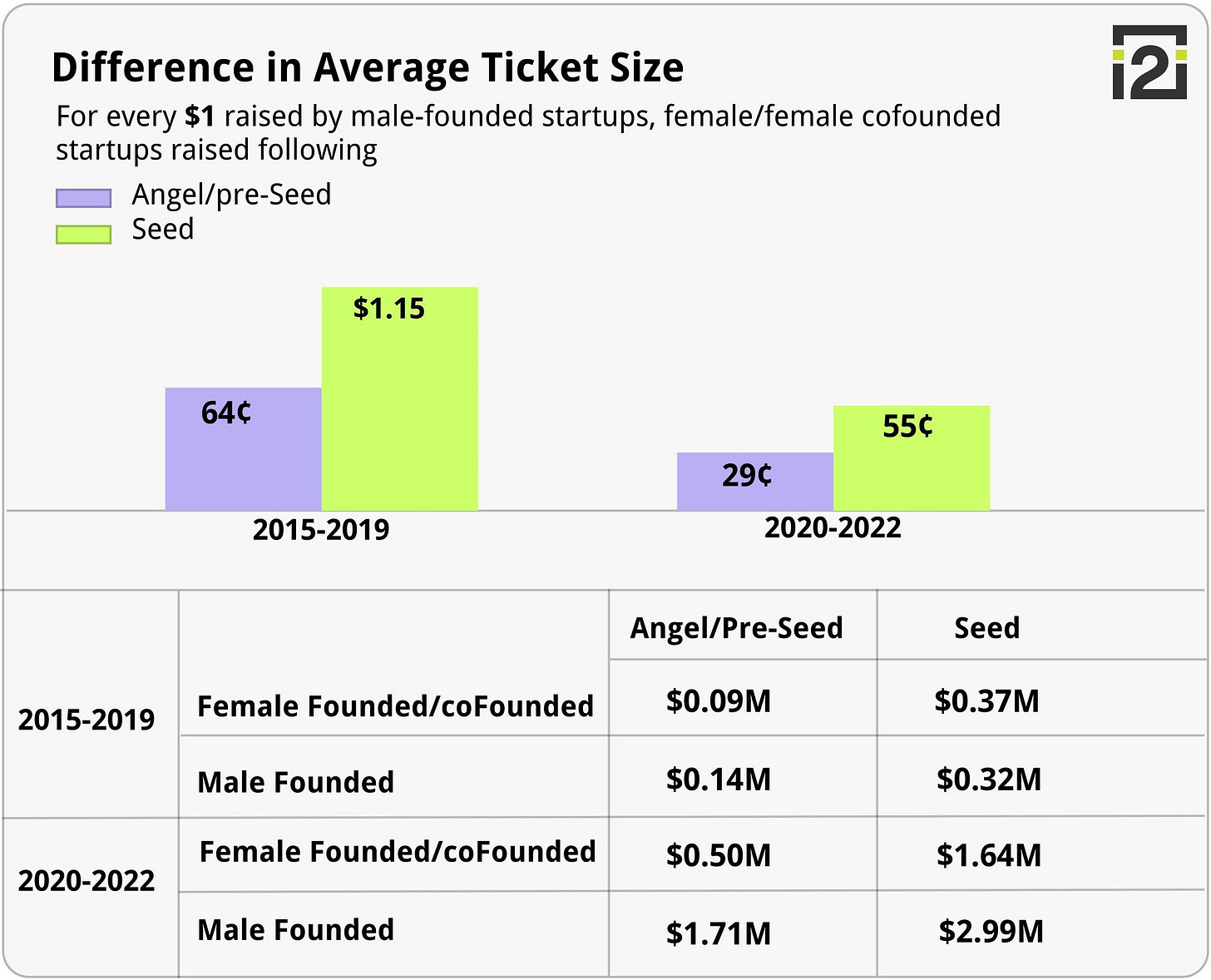

A disheartening metric for us was the difference in the average ticket size between female-founded/co-founded and male-founded startups. To make a comparison, we divided the startup funding cycle into two periods: 2015-2019 and 2020-2021. The startup ecosystem in Pakistan received global interest from 2020 onwards, especially in light of COVID-19, when e-commerce solutions received a significant boost.

When we compared the funding stages of these two periods in terms of average ticket size based on gender, we observed a significant difference in the amount of funding raised by female-founded/co-founded startups and male-founded startups. The gap has become so stark that, for every dollar invested in a male-founded startup between 2020-2022, female-founded and co-founded startups raised only 29 cents in the angel/pre-seed round and 55 cents in the seed round.

It can be argued that there are significant differences in the types of startups run by female founders and male founders. However, the analysis indicates that e-commerce and fintech are the top-funded sectors for all gender groups in our ecosystem. It raises the question of whether female-founded/co-founded companies set lower and perhaps more realistic valuations compared to their counterparts, and whether male founders are rewarded for setting higher valuations in their ask. Additionally, how do these gender groups determine their ask differently, which impacts the final cheque amount, and what steps do they take when a funding round is oversubscribed?

These questions are perhaps best left for future follow-ups, but they should be a point of reflection for all ecosystem stakeholders, especially the decision-makers. To create an inclusive startup ecosystem, all stakeholders must work together to tackle the prevalent pipeline and behavioral challenges simultaneously.

On a parting note, we would like to give a shout-out to the recently held WeRaise summit. WeRaise is a program by the World Bank and Women Entrepreneurs Finance Initiative (We-Fi), implemented by local and international partners Invest2Innovate, efino, and Spring Activator. The WeRaise summit brought together founders, investors, and ecosystem support organizations (ESOs) to explore gender funding gaps in more detail and identify potential solutions to address them. The discussions identified access to capital and networking as two major themes. Stakeholders voiced diversification of funding sources, apart from equity, as a crucial theme. Additionally, stakeholders identified 1-on-1 networking sessions as a potential solution to promote transparency in the ecosystem. The WeRaise team, including our team at Invest2Innovate, is finalizing the action plan. We hope all ecosystem stakeholders will help us shift the larger narrative as it takes a village to bring about change.

- - - - -

If you're a champion of gender lens investing and want to join us in moving the needle on the number of deals being closed by female founders, write to i2i team at armeen@invest2innovate.com.